The Best Guide To Custom Private Equity Asset Managers

Wiki Article

The Only Guide for Custom Private Equity Asset Managers

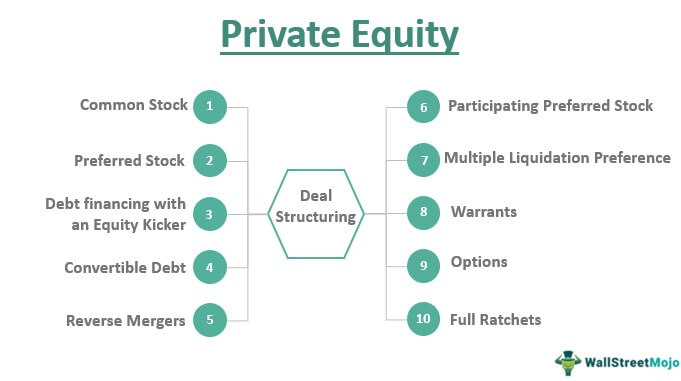

In Europe - a much more fragmented market - the correlation in between buyout funds and public equity is far lower in the very same time duration, often unfavorable. Given that exclusive equity funds have far extra control in the business that they buy, they can make a lot more energetic choices to react to market cycles, whether approaching a boom duration or an economic crisis.

In the sub-section 'Just how exclusive equity influences portfolio returns' over, we saw how consisting of personal equity in a sample profile enhanced the overall return while likewise increasing the overall danger. That claimed, if we consider the exact same kind of example put in a different way, we can see that consisting of exclusive equity enhances the return disproportionately to raising the risk.

For illustrative objectives only. Resource: Evestment, as of June 2019. These theoretical profiles are not intended to represent profiles that a capitalist necessarily would have been able to construct. The typical 60/40 profile of equity and set revenue assets had a risk level of 9. 4%, over a return of 8.

Our Custom Private Equity Asset Managers Diaries

By including an allowance to private equity, the sample portfolio risk boosted to 11. 1% - but the return also enhanced to the exact same figure. This is simply an example based on an academic profile, but it demonstrates how it is possible to use private equity allotment to branch out a portfolio and permit higher modulation of threat and return.

Moonfare does not supply investment guidance. You should not understand any details or other product given as legal, tax obligation, investment, monetary, or various other recommendations.

A web link to this file will certainly be sent to the following email address: If you would like to send this to a various have a peek at this site e-mail address, Please click right here Click on the web link once again. Asset Management Group in Texas.

All About Custom Private Equity Asset Managers

Eventually, the creators cash money out, retiring someplace cozy. Supervisors are hired. https://slides.com/cpequityamtx. Shareholders are no more running the business. This implies that there is an unpreventable wedge between the interests of managers and ownerswhat financial experts call company expenses. Agents (in this case, managers) may choose that benefit themselves, and not their principals (in this situation, owners).

Competitors have far better items and lower costs. The business makes it through, however it becomes puffed up and sclerotic. The sources it is usinglabor, resources and physical stuffcould be utilized much better someplace else, yet they are stuck since of inertia and some residual a good reputation. Culture is poorer due to the fact that its limited resources are trapped in operation worth much less than their potential.

In the regular exclusive equity financial investment, an investment fund utilizes cash raised from affluent people, pension funds and endowments of colleges and charities to get the company. The fund borrows cash from a financial institution, making use of the properties of the company as collateral. It takes over the equity from the spread investors, returning the firm to the location where it was when it was foundedmanagers as proprietors, as opposed to agents.

Custom Private Equity Asset Managers for Dummies

The exclusive equity fund sets up management with many times that risk. CEOs of exclusive equity-funded firms regularly get 5 percent of the firm, with the monitoring team owning as a lot as 15 percent.

This way, the value of private equity is an iceberg. Minority companies that are taken exclusive every year, and the excess returns they make, are the bit above the water: big and vital, however barely the whole tale. The gigantic mass listed below the surface area is the firms that have much better management due to the risk of being taken control of (and the management ousted and changed by private equity executives).

Companies aresometimes most efficient when they are exclusive, and occasionally when they are public. All firms start out personal, and numerous grow to the point where offering shares to the public makes feeling, as it permits them to decrease their cost of funding.

Custom Private Equity Asset Managers for Dummies

Exclusive equity funds give an invaluable solution by completing markets and allowing firms maximize their worth in all states of the globe. While private equity-backed companies surpass their private market rivals and, studies show, execute far better on worker security and other non-monetary dimensions, sometimes they take on also much financial obligation and die.

Bad guys in business motion pictures are commonly investment types, in contrast to builders of points. Before he was redeemed by the prostitute with the heart of gold, Richard Gere's personality in Pretty Lady was a private equity man. He chose to build boats, rather of acquiring and damaging up business.

American culture dedicates considerable resources to the private equity sector, however the return is repaid many-fold by enhancing the productivity of every business. We all advantage from that. M. Todd Henderson is teacher of law at the University of Chicago Law School. The sights revealed in this post are the writer's own.

Getting My Custom Private Equity Asset Managers To Work

Newsweek is dedicated to tough standard wisdom and searching for links in the search for common ground. Private Investment Opportunities.

We discover a coherent, regular image of patients doing worse after the nursing home is bought by exclusive equity. Werner pointed out that researches of nursing homes during the COVID-19 pandemic located that exclusive equity-managed institutions made out better than taking care of homes that weren't included in private equity at the time.

Report this wiki page